Financial debt help. Clear up to 80% of your personal debt

- Lower your monthly outgoings

- Write off up to 80% of debt*

- Stop debt letters and phone calls

- Freeze interest and charges

Solutions such as IVAs may not be suitable in all circumstances. Fees may apply and debt solutions will affect your credit rating. There is no charge for the initial call and advice, and you are under no obligation to proceed. *Up to 80% is based on an IVA solution.

How Does It Work?

We understand more than most that dealing with debt can be stressful, but we also know how it can be resolved. There are a number of tried and tested debt solutions that can help not only write off debt but also reduce pressure from creditors and freeze interest and charges. Get all the help and guidance you need to become debt free. These solutions help to repay what you can afford with the balance written off on successful completion.

All advice we give is free, confidential, and without obligation. Guaranteed.

Financial Benefits

of a Debt Solution

- End borrowing from friends & family

- Stop the stress of bills you can’t pay

- No hefty charges for being overdrawn

- Get rid of those loans

- No running out of money after payday

- Enjoy living life again

We are proud of our 5* Trustpilot reviews

Our 3 Step Process

1. Get Started

Here Answer a few questions to check if you qualify to write off debt.

2. Speak To An Expert

Chat to one of our debt experts for your personalised plan.

3. Relax

Leave the rest to us and get back to enjoying life without the money worries.

You could be on your path to debt freedom

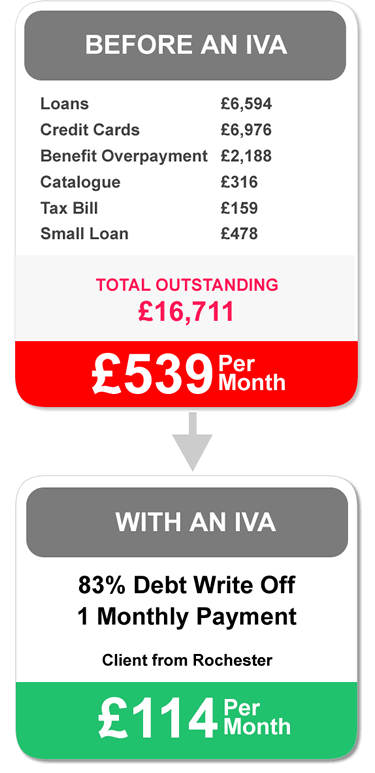

Your financial future could look like this.....

Frequently asked questions

What options are available to me?

Each situation is different. To determine what options are available, an income and expenditure form would need to be completed to understand what your affordability is. This would then determine what options are available to you. In England, Wales & Northern Ireland there are options including self-help, informal arrangements, Debt Management Plans (DMP), Consolidation loans, Individual voluntary arrangements (IVA), Bankruptcy, Debt Relief Order (DRO), Administration Orders. In Scotland, options include self-help, informal arrangements, consolidation loan, Protected Trust Deed, Sequestration & Minimal Asset Process.

What is an IVA?

An individual voluntary arrangement or IVA is a formal agreement between you and your creditors. It is a fixed-term debt plan that legally protects you from your creditors. An IVA freezes interest and cuts your monthly repayments to an affordable level. Better still, any debt left unpaid when the term finishes is written off. The exact amount of your monthly payment will depend on your circumstances but can start from as low as £70. If you are a homeowner, once your IVA is approved your home can be protected. If you have a private pension this can also be protected. If you have a private pension this will also be protected. Typically an IVA will last for 5 years with you making an affordable monthly payment from your income into your IVA. Once your IVA has been fully approved, you don’t need to worry any more about your creditors pursuing you. Your insolvency practitioner who supervises your IVA will deal with all your creditors. Once the final IVA payment is made, you are no longer be liable for any of the debts included in your IVA and there will be no further balance to pay, even if this means your debts have not been repaid in full.

Will my creditors stop contacting me?

Yes, once your IVA is approved all collections contact from creditors should cease however they still legally have to send you some items like annual statements. It may take a while for creditors to amend their systems but within 1 to 2 months of the IVA starting, all communication from your creditors should stop. Creditors are legally bound into the terms of an IVA, consequently preventing them from pursuing you for the debt.

Can I get help for free?

We provide free no-obligation advice to anyone who is considering whether an IVA is the right solution for them. All options will be explored and if you decide that an IVA is not for you we will help you find the solution best suited to your circumstances. Free debt advice and information is also available to customers from Money Helper (www.moneyhelper.org.uk/en/money-troubles/dealing-with-debt)

Will an IVA freeze interest and charges?

Immediately after your IVA is approved all interest on your unsecured debts and all charges will be frozen. It is important to note that debts such as mortgages or ongoing car finance will not be included in your IVA and you will continue to pay these as normal. After your IVA is approved you may continue to receive correspondence from some of your creditors. All you need to do is to send this to the supervisor of your IVA who will remind those creditors to update their records to show that you are in an IVA and they must only deal with your IVA supervisor from now on. If your IVA is terminated because you don’t keep to the agreed terms then the interest which was frozen is likely to be added back to your debts.