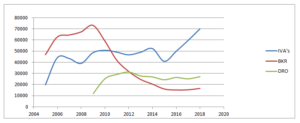

Since their inception in 1990, the number of IVA’s approved by creditors has steadily increased year on year, (allowing for two small drop offs in 2008 and 2015), with 2018 projected to be yet another record breaking year. IVA’s really started to become a mainstream form of insolvency around 2009 following the introduction of IVA Protocol, a code of conduct which has been agreed between IVA providers and regulators such as the Financial Conduct Authority (FCA). The Protocol standardised the IVA process and significantly reduced the cost to allow consumers with less than £15,000 of debt and make contributions of less than £200 per month.

Today IVA’s are more popular than ever and projections for 2018 show they are estimated to continue to rise as more and more people are struggling with debts and are looking for help. The Debt Advisor have been proposing IVA’s for almost 20 years and have helped thousands of people gain financial stability and free themselves from unmanageable amounts of debt. With high profile cases being shown in the news and celebrities now proposing IVA’s, the stigma attached to receiving help with your debts has been significantly reduced and more and more people are finding they do not have to continue to struggle in silence.

The hardest part of the whole process is picking up the phone and asking for help, we understand that talking about your debts and money worries can bring on unbelievable amounts of anxiety and you are not alone, however continuing to ignore your creditors will only make things worse. Our understanding and empathetic advice team are happy to offer free and impartial advice and have likely heard a story like yours before. Take a read through some of our IVA case studies here for examples of how we have helped people just like you in the past.

For free, impartial and helpful advice, call The Debt Advisor free today on 0800 085 1825 With nearly 20 years of experience in helping thousands of customers, The Debt Advisor team are adept at helping with all debt problems.

The Debt Advisor Ltd is regulated by The Financial Conduct Authority No 659920 and can offer help and advice on all debt solutions. There is also free advice available through The Money Advice Service who you can call on 0800 138 7777.