With more and more people bypassing traditional lenders, the extent of lending between family and friends is increasing at a phenomenal rate. According to Scottish Widows research in March 2012, the number of family loans has increased by 31% in the past 5 years.

A 2014 poll by Payleven in 2014 reports that adults lend on average around £272 a year informally.

The findings of a recent research by Scottish Friendly, a leading UK Mutual life and investment organisation make for interesting reading:-

- 7 million people say that they have lost contact with a friend because of a financial dispute

- 1 in 3 people aged between 24 and 35 admit to losing friends over finance

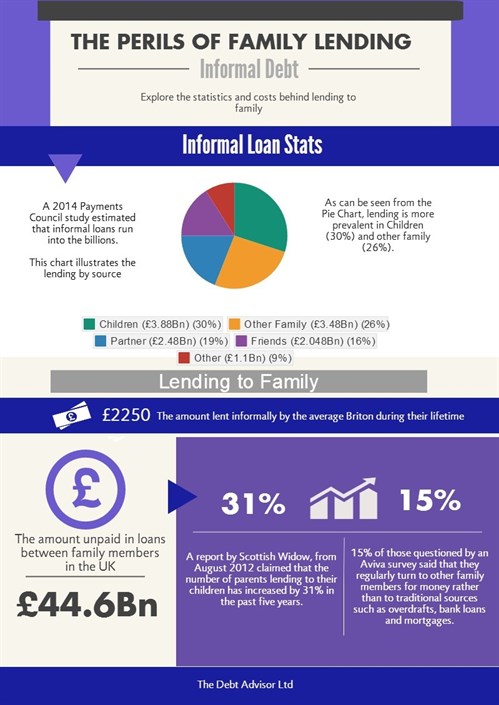

Family lending is big business, according to a 2014 report by the Payments Council which estimates that informal loans run into the billions.

Helping families or friends with their finances is extremely common and can often literally be a lifesaver. However, it is very easy for the arrangement to go wrong and keeping to some useful guidelines could help to make these transaction successful.

UNDERSTAND THE REASONS FOR THE LOAN

It’s really important to have clear and open communication between the lender and the borrower. Bev Budsworth, from The Debt Advisor Ltd comments “You could be throwing money into a bottomless pit. It’s vital to have an understanding of the underlying reasons for the need for the loan. If the borrower is reluctant to share information, treat this as a warning sign that there may be serious problems that your loan may not resolve. You could find yourself in a difficult position where you feel obliged to keep lending in the hope of protecting the sums you have loaned in the first instance”.

Loans between family and friends often go bad because they are rooted in dispute. Lenders that feel pressurised into giving money are likely to later on feel resentful.

GET THE TERMS DOWN IN WRITING

This sounds very formal but its sensible and lets the borrower know that you are serious about getting your loan repaid. If the loan is significant, think about taking security. This is particularly relevant if your loan is to bail out someone already in debt. Taking security before you lend the money cannot then be attacked later on as a preference, Bev Budsworth adds.

Another option could be using a semi-formal lending service like Agree It which allows people to lend to friends or family through Facebook although again there is no obligation for them to repay the debt.

ALTERNATIVES TO FAMILY LOANS

The potential for future misunderstandings and the difficulty in asking for and getting acceptable terms can sometimes make borrowing from a family or friend more trouble than its worth.

Alternatives include peer to peer sites such as ZOPA which allows those with money to lend to those seeking money to borrow. Lenders set their own interest rates and choose how long they are willing to lend their money for.

To reduce the risk of defaults, borrowers are subject to stringent checks. As a result more than 75% of those who apply for loans through sites like ZOPA are turned down.

Credit Unions may also be able to help and their interest rates are generally very competitive.

LOANS TO SORT DEBT ISSUES

Bev Budsworth warns about family and friends wading into help with debt issues. As detailed above there needs frank disclosure about the reasons for the debt and the full extent of the debt. Also professional help and advice should be sort as there any options which allow individuals to repay as much of their debt as they can afford over a defined period of time with the balance being written off (Individual Voluntary Arrangements). If there are assets these can be protected with sums in lieu of equity being introduced into an IVA. Bankrupty may also be appropriate if the family member has little or no assets. It is also possible to offer an IVA which is based on a lump sum settlement “a full and final settlement”. The family could take security over property to secure the sum advanced and once the IVA is settled, the family member could then repay the debt over a period of time.

If you are struggling with debt issues, whether these are business or personal debts, The Debt Advisor Ltd which incorporates The Business Debt Advisor can help. There are a range of solutions available which include both formal and informal solutions such as Debt Management Plans (DMP), Individual Voluntary Arrangements (IVA), Bankruptcy as well as solutions for Businesses.

There is also free help and advice available through a variety of debt charities. For more information, we recommend you visit www.moneyadviceservice.org.uk.

The Debt Advisor is regulated by The Financial Conduct Authority and is also a member of the DRF and we adhere to their codes and standards.

Call us today on 0800 0851 825 to speak with one of our advisors. If you’re calling from a mobile you can reach us on 0333 9999 600.