The Money Charity have released their quarterly ‘Money Statistics’, giving an insight into the current state of Briton’s finances.

Personal Debt

Total personal debt in the UK was £1.475 Trillion for Q1 of 2016. This is up from £1.437 Trillion for the same period last year. While a seemingly small increase, it equates to an extra £762.67 on average per adult in the UK.

Including mortgages, the average debt per household was £54,636 in Q1 of 2016. This equates to £29,210 per adult, accounting for around 112% of average earnings. This figure is up slightly for Q1 of 2015 which stood at £53,634. Statistics for Q1 2009, a time when consumers were feeling the effects of the credit crunch show that this figure was £58,370

Total credit card debt over Q1 2016 was £64.4BN, or about £2,387 per household; a small increase from Q1 2015 of £2,307. Shockingly, it would take you over 25 years to pay this off if you made the minimum payment each month.

The Office for Budget Responsibility has predicted that personal debt will reach £2.551 Trillion by the first quarter of 2021.

Personal Insolvencies

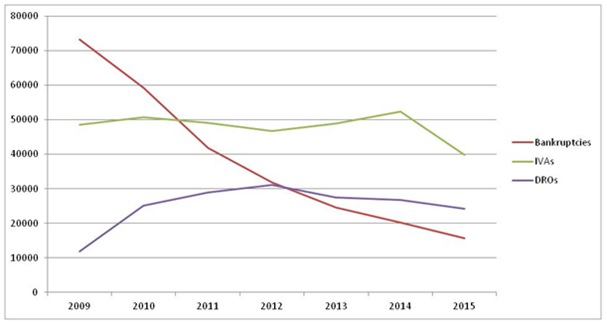

Overall figures for personal insolvencies have been steadily declining since 2011. Q1 2016 saw 20,382 individual insolvencies in England and Wales; around 226 people a day, or one person every 6 minutes 13 seconds. This was down by 2.2% from Q1 2015.

Although overall figures for insolvencies have decreased this quarter, there was an increase in the number of Debt Relief Orders (DRO) this quarter.

On an average day in the UK, 42 people were made bankrupt, 110 Individual Voluntary Arrangements were entered into and 75 Debt Relief Orders were granted.

The next quarter to June 2016 is likely to see an increase in the number of bankruptcies as petitions are now filed on line rather than at court. The process is now a lot less daunting and the cost has also reduced from £705 to £655 and this can be paid by instalments, although the petition application will not be considered until the £655 has been paid in full. The petitions are all reviewed by a specialist team in The Insolvency Services who is satisfied the petition is appropriate, then process the Bankruptcy Order.

If you are struggling with debt there are a range of solutions available. If you are struggling, please do give our team a call on 0333 9999 600 or use our contact form. Our advisors can speak with you about all available debt solutions such as Debt Management, IVAs, Bankruptcy and Debt Consolidation.

All debt solutions need to be carefully considered. IVA’s are formal solutions and failure to keep to the terms can result in your IVA failing and you could end up bankrupt.

There is also free debt help and advice available through a variety of debt charities. For more information, we recommend you visit www.moneyadviceservice.org.uk.

The Debt Advisor is authorised and regulated by The Financial Conduct Authority (reg no: 606669). We are also a member of the Debt Resolution Forum and we adhere to their codes and standards.