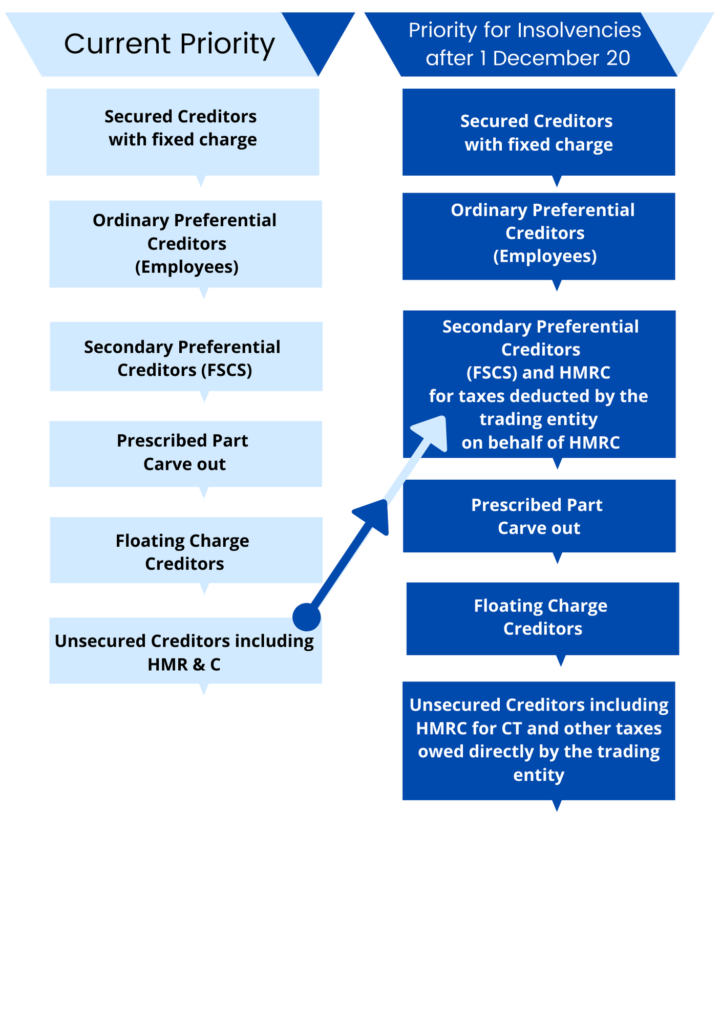

The Finance Act 2020 provides for HMRC to regain preferential status for certain debts including PAYE, Employees NIC, VAT, student deductions and CIS deductions. The new status is only relevant for insolvencies that commence after 1 December 2020.

Current Preferential Creditors

At present the only creditors that have preferential status are employees for arrears of wages and holiday and Financial Services Compensation Scheme “FSCS”.

For new insolvencies where the approval date is after 1 December 2020, HMRC will join FSCS as a secondary preferential creditor in relation to the type of debts referred to above.

The preferential status is limited to outstanding taxes which are deducted from an employee’s salary or deducted from customers and are held on behalf of The Revenue “deducted taxes”.

HMRC will remain as an unsecured creditor for corporation tax or any other tax owed directly by the trading entity which includes all trading entities including companies, partnerships, sole traders, charities, etc.

How does this affect insolvencies?

What this means for insolvency processes including administrations, liquidations, Company and Individual Voluntary Arrangements, which commence post 1 December 20, HMRC will jump up the queue above both secured and unsecured creditors and if there are surplus funds to distribute to creditors, HMRC will be 2nd or 3rd in the queue after creditors with a fixed charge and employees as detailed.

Does this mean reduced returns to creditors?

If HMR & C is a large creditor “deducted taxes” they will now jump ahead of unsecured creditors and secured creditors (with a floating charge) which could mean that there are no funds then available to pay to these creditors.

Likely affect on new insolvencies

CVA’s and IVA’s for traders?

Voluntary Arrangements for companies and traders who have large revenue debts may no longer be viable. The contributions or asset realisations paid into the arrangement will have to first clear HMRC (if they have a claim for “deducted taxes”). This could mean that the arrangement has little appeal to unsecured creditors as they will not see a return.

Liquidations

Are HMR & C likely to take more of an interest in fees charged by Insolvency Practitioners and start to cap these to improve the return to ordinary and secondary preferential creditors? At present, HMRC tend not to vote on liquidations where creditors do get a say on who is appointed as Liquidator and also the level of fees and expenses charged.

Administrations

Secured creditors with floating charges may be less likely to want to support an administration which sees little return on their floating charge. This could actually benefit company’s under financial pressure as the secured creditors may be more inclined to look at a mutually agreeable restructure rather than insolvency.

How will this influence lending decisions?

The change is likely to affect lender’s appetite to lend to companies where the security includes a floating charge. Typically this will include business overdrafts which banks have traditionally made available secured by a fixed and floating charge. The fixed charge often provides limited cover on assets such as goodwill and fixed equipment while the floating charge then covers all other assets.

The overdraft has been under pressure for some years leaving smaller companies with no option but to take on loans from secondary lenders which are secured by personal guarantees which will be called in if the company fails.

Lending in the current environment has to an extent dried up and the elevation of the Crown to a preferential creditor will make this far worse. Apart from providing what could be hefty personal guarantees, lenders will look to secure their debts on fixed charge assets or on book debts (factoring) which comes with increased costs and restrictions on the use of these assets.

The Debt Advisor and The Business Debt Advisor have been in existence for 21 years and we have gained a reputation as the “go to” practice for debt advice and debt solutions for both companies and individuals. The company is authorized and regulated by The Financial Conduct Authority “FCA”and Beverley Budsworth, MD is a licensed Insolvency Practitioner regulated by The Insolvency Practitioners Association.

Get Debt Advice Today

If you would like to speak to one of our team on either business or personal debt, call us on 0800 085 1825 or arrange a callback.